Finding accepted for the ninety five% LTV property finance loan in 2nd placement has not been uncomplicated. Getting a 2nd property finance loan with little if any fairness can difficult to discover today, so take full advantage of our free products and services with no software cost at any time.

The acceptance time varies, but it is best to expect the process to consider among six to eight weeks from your time we obtain the appliance. Aspects like credit score historical past, documentation and house appraisal can influence the timeline. Speak to your bank loan expert for a more personalized estimate.

When the next house loan is “silent” because no payments are essential until eventually the assets is sold or refinanced. Nevertheless, in some instances, using out a silent second home finance loan with no informing the principal lender is illegitimate and constitutes property finance loan fraud.

The upper the fees and APR, the more the lender is charging to obtain the loan. The remaining fees are usually relevant to all lenders, as They may be determined by products and services and policies the borrower chooses, Together with community taxes and governing administration charges.

The lender will provide you with a doc that outlines each of the conditions in the personal loan currently being offered. The knowledge provided will incorporate the premiums and fees that you will be responsible for.

For those who don’t have more than enough fairness to qualify for a conventional dwelling fairness personal loan, you could consider other options:

The products and services that 95 loans provides are completely no cost for you! We don't cost any costs for matching you with payday lenders in our community.

Modify the graph below to find out historical click here house loan premiums personalized in your bank loan software, credit history score, deposit and placement.

When applying for any 95% LTV HELOC, you’ll need to have to collect some vital files. Right here’s Anything you’ll typically require:

Not like standard loans, which might be determined by your present-day residence value or need you to refinance your Major home loan and provides up your minimal rate, RenoFi loans are dependant on the Soon after Renovation Price of your own home.

You may use the money for startup charges, getting inventory, or increasing your operations. This feature provides much more adaptability than standard business loans.

Why pass up out on homeownership chances whenever a silent next property finance loan could bridge the fiscal gap legally and responsibly? Just make sure that any secondary funding is totally disclosed to all get-togethers involved.

To qualify to get a ninety five% LTV HELOC can be more durable than Conference the requirements for loans with decreased LTV ratios. Listed below are The real key factors lenders typically Examine when selecting in the event you qualify:

Chance to Your private home: With a 95% LTV HELOC, there’s a higher danger of dropping your private home If you're able to’t sustain with payments or the worth of your respective residence drops.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Tiffany Trump Then & Now!

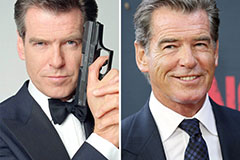

Tiffany Trump Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!